NBA Lockout Reboot: What If Players Only Earned What They Won?

B on October 13, 2011

Whenever there is a labor struggle in sports, or any time money gets in the way of fans being able to enjoy watching their favorite teams play, my brain immediately thinks about ways to blow up the system and start from scratch. (I've seen Fight Club too many times.) Now, with the NBA already pulling the plug on at least two weeks of the regular season, the voice inside my head keeps yelling to blow the whole thing up (and, for some reason, make lots of soap).

So let's have a little fun and blow it up (hold the soap). What if the NBA had a system where players got paid like independent contractors? What if, as crazy as this would be, players in the NBA got paid more for winning more?

This works for individual sports. In golf, the higher a player places, the more money that player wins. In tennis, the deeper a player goes into a tournament, the more money that player wins. In auto racing, to a lesser extent than other individual sports, winning races means bigger paychecks. Heck, in poker —which I know isn't technically a sport even if ESPN shows hours of it every week—players put up their own money (or a sponsor stake) to win based on well they do.

Ronald Martinez/Getty Images

Ronald Martinez/Getty Images The NBA salary cap has been fluctuating between $55 million and $58 million for the last five years. Of course, that doesn't include all the mid-level exceptions and rookie exceptions and Larry Bird exceptions and whatever other exceptions the league had in place to make the NBA labor situation the most confusing thing ever constructed in sports. While I know the owners are looking to take money away from the players during this lockout, for the purposes of having fun while completely blowing things up, let's round the payroll average up to $60 million per team and start from there.

An average payroll of $60 million for 30 teams means the NBA salaries would be somewhere in the neighborhood of $1.8 billion per year, spread between 450 players, give or take a few 10-day contracts. Those numbers neatly average out to $4 million per player, which we can use as a baseline for the average NBA salary. Again, the numbers are estimates and I know it's not as cut-and-dried as 15 full-time players on 30 teams, considering guys are constantly getting cut and picked up by other teams, or getting traded, then cut, then picked up by the team that traded them for less money. It's an odd system…and it's probably good that we're thinking about blowing it up.

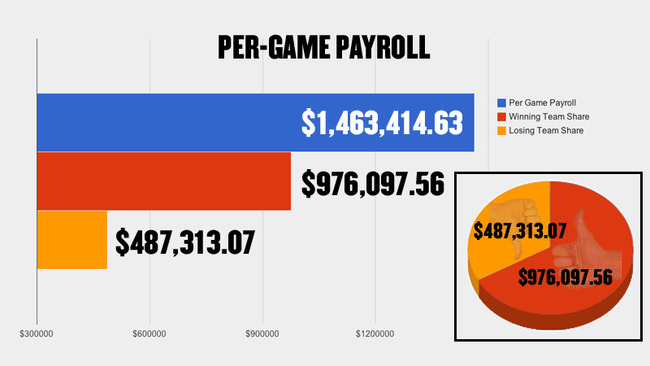

Forget, for a moment, about paying that $1.8 billion out evenly to every player, and let's think about paying it out evenly per game played. There are 1,230 games in a full NBA season. (To follow along with the math, that's 30 teams x 82 games ÷ 2 teams per game = 1,230 games.)

Now, that number assumes that teams would earn the same salary just for playing, with no financial reward for winning. That number also assumes that all the players on each team earn the same amount of money. Both of those assumptions are insane, so let's get a little more in depth on each.

WIN AND GET PAID

First, let's calculate the value of a "winner's share" for each game. If the overall game checks total almost $1.5 million, it's a rather simple breakdown: give the winning team two-thirds of the money while the losing team gets one-third. Based on our per-game payroll of $1,463,414.63, the winning team would garner $976,097.56 per game with the losing team earning $487,313.07 just for showing up.

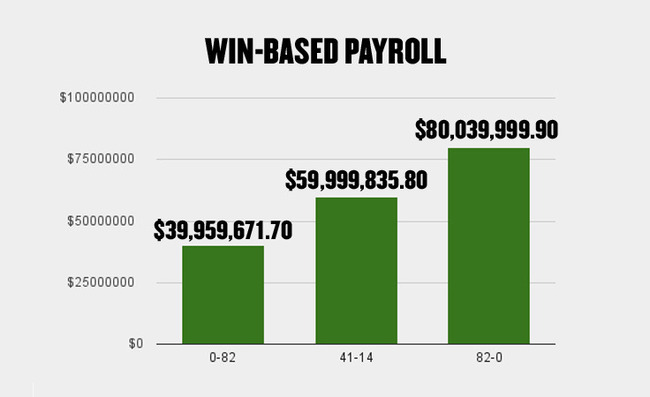

Under this model, a team that wins half its games (41-41) would have an overall payroll of $59,999,835.83, which is higher than some really good teams last year, including the Bulls and Thunder.

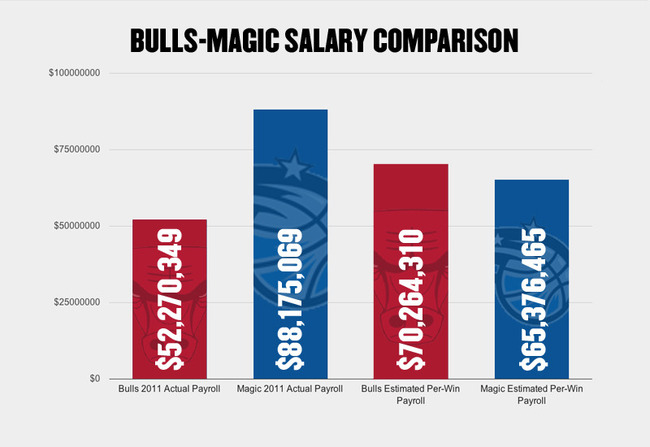

Staying with the Bulls for a moment, Chicago won 62 games last season, and according to Forbes, was the most efficient team with regard to cost per win. The Bulls only cost their owners $843,070 per win. The Magic, by comparison, cost their owners $1,695,674 per win. But under this new proposed model of paying teams more for each victory, teams would earn what they deserve based on how well they do, not how well their agents can negotiate. The Bulls players wouldn't have a payroll of just over $52 million while the Magic players collect $88 million for 10 fewer wins. Based on last year's win totals, the Bulls would earn $70,264,310 while the Magic would take in $65,376,465.22.

WHO GETS PAID WHAT?

Marc Serota/Getty Images

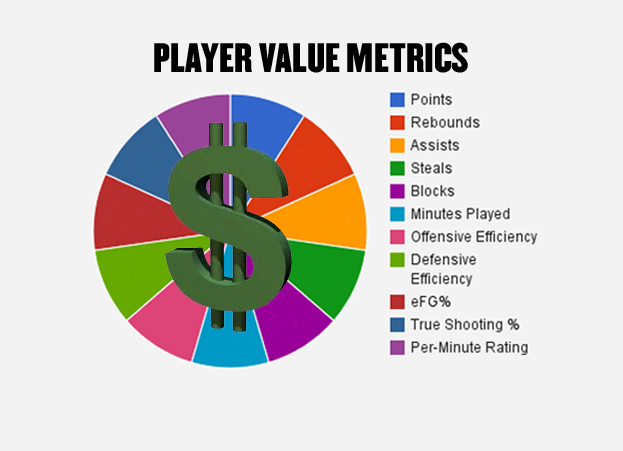

Marc Serota/Getty Images There are a lot of options, depending on how a franchise wants to run its team. If having 12-15 players of average ability running in and out every game in an effort to stay fresh throughout the season is a model that works for one franchise, they could, in theory, pay everyone the same amount. If a franchise wants to lean on one or two (or three) high-paid superstars and fill the roster with role players, they can easily work up a pre-determined percentage of what certain players will make during the season.

If the Miami Heat decided to give 75 percent of their earnings to LeBron James, Chris Bosh and Dwyane Wade, then split the remaining 25 percent between the other players on the team, they'd basically have the same model they used last year, only the big three would have gotten more than a million dollar salary bump with this model, based on their 2010-11 record.

Certainly this method could lead to chaos and dissent in the locker room. Nowadays, players shouldn’t mind being in a coach's doghouse because the player is guaranteed to get his salary whether he plays 48 minutes or 48 seconds. Under the new model, the less a player plays (and plays well) the less he gets paid.

Suddenly the old Shaq model of taking a month off during the regular season would impact the players' paychecks. Sure, if a player gets hurt, he runs the risk of losing out on a ton of money, but if was on the roster, he'd still be getting the minimum salary, and even more if he negotiated a greater percentage of earnings with his team. Besides, factoring injuries into the equation is part of the point of this exercise: If Tiger Woods played a team sport, he would have made $30 million the last few years to sit on the bench and ice his knees and wrist and back and pride, while less talented golfers played for far less money in his place.

Scott Halleran/Getty Images

Scott Halleran/Getty Images Look, there are a million reasons why this would never happen, most notably because I haven't figured out a way where it could benefit the owners or the great players who get stuck on bad teams. So before I have an army of economists telling me how crazy this idea is, just remember the point of the exercise: imagining how NBA players would suit up for every single game with money on the line.

Read More...

No comments:

Post a Comment